|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

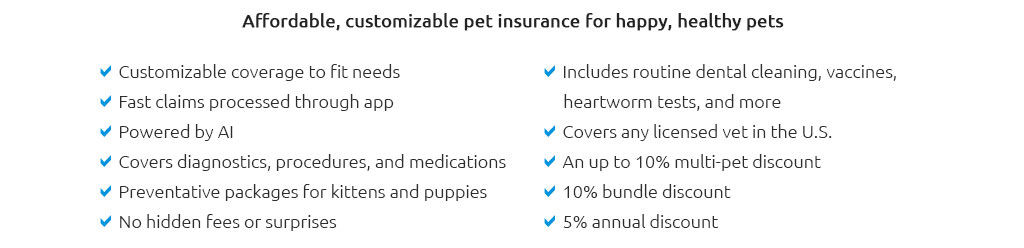

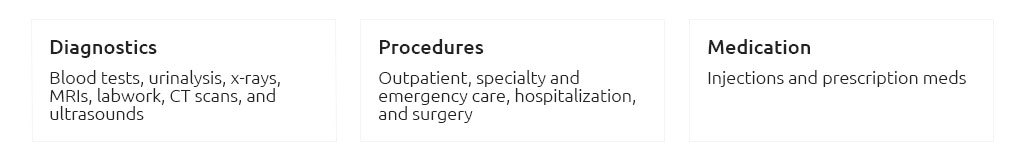

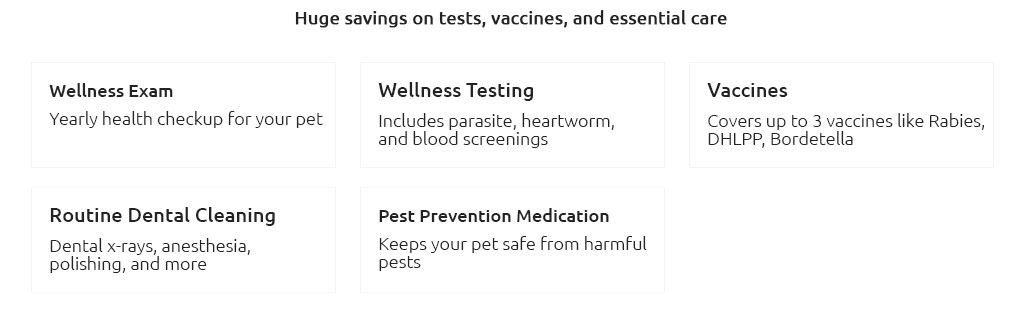

Understanding Pet Insurance for Cats and DogsPet insurance, a safeguard often overlooked in the early days of pet ownership, can be a crucial component in ensuring the well-being of your beloved cats and dogs. As veterinary costs continue to rise, pet insurance offers a financial buffer against unexpected medical expenses. It is imperative to comprehend what pet insurance entails and how it can be beneficial for your furry companions. Why Consider Pet Insurance? The decision to invest in pet insurance often stems from a desire to provide the best possible care without the constant worry of financial strain. With advances in veterinary medicine, treatments have become more sophisticated-and costly. This is where pet insurance comes into play, offering peace of mind by covering a portion of these expenses. Types of Coverage Understanding the types of coverage available is crucial. Generally, pet insurance policies are categorized into three main types: accident-only, accident and illness, and comprehensive plans.

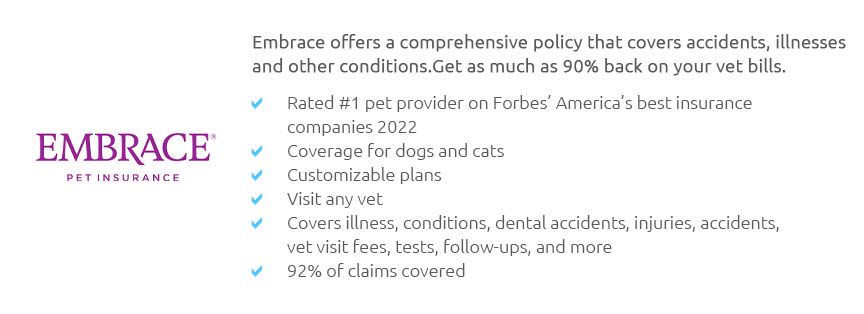

Factors Affecting Premiums Several factors influence the cost of pet insurance premiums. These include the pet’s age, breed, and health condition. For instance, older pets or those with pre-existing conditions may attract higher premiums. Similarly, certain breeds prone to hereditary conditions might also cost more to insure. Choosing the Right Policy When selecting a pet insurance policy, it's important to assess your specific needs and budget. Research various providers, compare their offerings, and read customer reviews. Consider the policy's coverage limits, deductibles, and reimbursement levels. A policy that suits one pet owner might not necessarily be the best choice for another. Benefits and Drawbacks While pet insurance can significantly mitigate unexpected costs, it’s essential to be aware of its limitations. Not all procedures may be covered, and there might be waiting periods before certain benefits take effect. Additionally, most policies exclude pre-existing conditions, so it's wise to enroll your pet when they are young and healthy. Final Thoughts Pet insurance for cats and dogs serves as a valuable tool in managing veterinary expenses. By understanding the intricacies of different policies, pet owners can make informed decisions that align with their financial situations and their pet's healthcare needs. Frequently Asked QuestionsWhat does pet insurance typically cover?Pet insurance typically covers unexpected accidents and illnesses. Some policies may also include wellness care, which covers routine check-ups and vaccinations. Is there a waiting period for pet insurance coverage?Yes, most pet insurance policies have a waiting period before coverage kicks in. This can range from a few days to several weeks, depending on the policy and the type of coverage. Can I get pet insurance for an older pet?Yes, you can get insurance for an older pet, but premiums might be higher. Some companies may also have age limits or restrictions on enrolling senior pets. How do I choose the best pet insurance for my pet?To choose the best pet insurance, consider factors like coverage options, cost, customer reviews, and any specific health needs your pet may have. Comparing multiple providers can help you find the best fit. https://www.petinsurance.com/

Nationwide protects more than 1,000,000 pets - Pet insurance premiums starting at $13/mo.* - Visit any licensed veterinarian in the United States - Cancel at any ... https://www.usnews.com/insurance/pet-insurance

Coverage and Costs: ASPCA has a sample rate of $25.47 per month to insure a cat, and $42.24 per month to insure a dog. Its accident-and-illness policies include ... https://www.nerdwallet.com/p/best/insurance/pet-insurance-companies

MetLife, Embrace and Pets Best top our list of the best pet insurance companies. Many, or all, of the products featured on this page are from ...

|